The Invitations

Let me start with a simple observation.

Periods when markets go nowhere are far more uncomfortable than periods when markets fall sharply.

A sharp fall feels dramatic. A flat market feels pointless.

And yet, if you look closely at market history, the flat periods are often the most misunderstood, the most frustrating, and the most rewarding phases for long term investors.

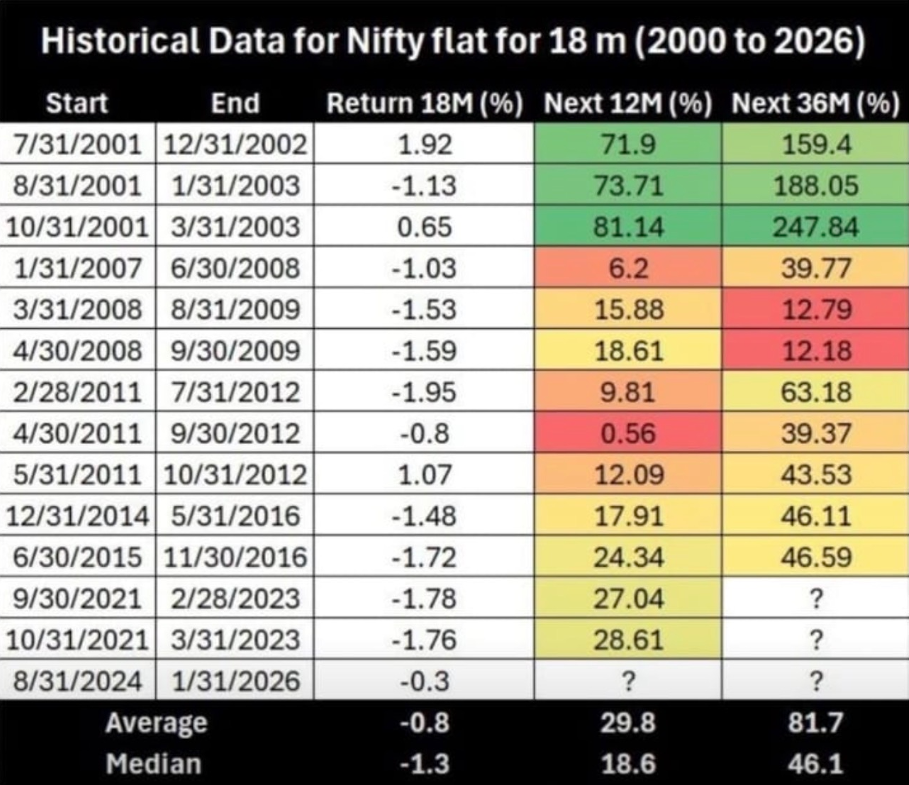

The table you see captures something very important. It looks at multiple periods since 2000 where the Nifty delivered almost nothing for about eighteen months. Sometimes slightly positive. Sometimes slightly negative. On average, nearly zero.

For an investor living through those eighteen months, the experience would have felt miserable.

No returns.

No excitement.

No validation.

Plenty of doubt.

This is where most investors start questioning everything.

Is equity still worth it?

Should I exit and wait?

Should I switch strategies?

Should I move to something safer?

Is this time different?

These questions do not arise when markets are rising. They arise when time passes and nothing seems to happen.

But now look at what happened next.

After these flat eighteen month periods, the next twelve months and the next thirty six months delivered substantial returns in many cases. Sometimes very strong returns. Sometimes spectacular ones. On average, the following three years were anything but flat.

This pattern is not an accident.

Flat markets are not dead markets. They are markets digesting.

They digest excesses.

They digest fear.

They digest optimism.

They digest valuation.

They digest narratives.

They are doing the hard work of resetting expectations.

And this is where the real lesson lies.

Most investors think returns come from timing the beginning of rallies. In reality, a large part of long-term returns comes from surviving the boring parts.

Flat markets test patience more than intelligence.

When markets fall sharply, even new investors understand fear. They expect pain. They brace themselves.

When markets go nowhere, investors feel cheated. Time passes. SIPs continue. Statements look dull. And slowly, conviction erodes.

This is when investors make their worst decisions.

They stop SIPs.

They redeem to do something else.

They chase what is moving.

They abandon discipline because nothing seems to be working.

But flat periods are not wasted time. They are compounding invisibly.

Businesses continue to grow.

Earnings continue to accumulate.

Cash flows continue.

Balance sheets strengthen.

Managements adapt.

Weak hands exit.

Strong hands accumulate.

Price may not reflect this immediately, but value keeps building quietly.

The table shows something else that is equally important.

Not every flat period is followed by immediate fireworks. Some twelve month returns were modest. Some were disappointing. But when you extend the lens to thirty six months, the picture changes meaningfully.

This brings us to one of the most important truths in investing.

Time does the heavy lifting. Not activity.

The mistake many investors make is shortening their patience exactly when patience is most needed.

They give markets eighteen months.

They give strategies one year.

They give equity a trial period.

Markets do not work on trial periods. They work on cycles.

And cycles are rarely neat.

Flat markets are often the bridge between excess and expansion. They are uncomfortable because they offer no emotional payoff while demanding discipline.

This is why the question you must ask yourself during such phases is not “What should I do now?”

The better question is “What is this phase designed to teach me?”

It teaches you the difference between interest and commitment.

It teaches you whether your asset allocation is real or theoretical.

It teaches you whether you understand risk or only enjoy returns.

It teaches you whether your strategy is built for boredom as much as for excitement.

Many investors say they are long term. Flat markets reveal who actually is.

Let us also talk about expectations.

A lot of disappointment during flat phases comes from unrealistic expectations. Investors mentally anchor to recent returns.

If the previous years delivered strong gains, the mind expects continuity. When that does not happen, frustration builds.

But markets do not owe us linear progress.

They move in bursts.

They pause.

They regress.

They consolidate.

They surprise.

The data shows that periods of apparent stagnation often precede periods of meaningful progress.

But only for those who stayed.

This is where behavior matters more than math.

The math is clear in hindsight. The behavior is difficult in real time.

Flat markets feel like wasted time because humans equate action with progress. Investing often requires the opposite. Staying put. Continuing a plan without emotional feedback.

This is why having a well thought out plan matters more during flat periods than during bull markets.

When markets rise, even poor plans look good.

When markets stagnate, only good plans survive.

A good plan accounts for boredom.

It accounts for doubt.

It accounts for phases where returns are delayed.

It accounts for the fact that equity rewards patience unevenly.

Another important insight from the table is dispersion.

Not every flat period leads to the same outcome. Some lead to extraordinary recoveries. Some lead to moderate ones.

This reminds us of something essential.

We invest not because we know exactly what will happen next, but because we understand probabilities over time.

Equity investing is not about certainty. It is about participation in long-term growth despite uncertainty.

Flat markets reduce narrative noise. They strip investing down to its core.

Do you believe in the long-term growth of businesses?

Do you believe in productivity, innovation, and enterprise?

Do you believe that earnings matter eventually?

Do you believe that discipline works?

If the answer is yes, flat markets are not enemies. They are invitations.

Invitations to accumulate quietly.

Invitations to rebalance sensibly.

Invitations to strengthen habits.

Invitations to detach emotion from outcome.

Most wealth is not created by catching tops or bottoms. It is created by staying invested through dull stretches that others abandon.

The irony is that when markets finally break out of flat phases, participation is already lower. Many have exited. Many are skeptical. Many wait for confirmation.

And by the time confirmation arrives, prices have already moved.

This is why the best returns often go to those who felt uncomfortable but stayed.

Flat markets are the price you pay for long term equity returns.

They are the waiting room of compounding.

If you cannot sit through them, you do not get access to what comes next.

If you find yourself looking at your portfolio after months of nothingness, ask yourself a different question.

Is the market broken, or is it simply doing its job?

Because history suggests that markets often reward patience right after they have tested it the most.

And the real edge in investing is not prediction.

It is endurance.

and then tap on

and then tap on

0 Comments