A Powerful Investing Question

Every investor believes they are making decisions based on facts. Very few actually are.

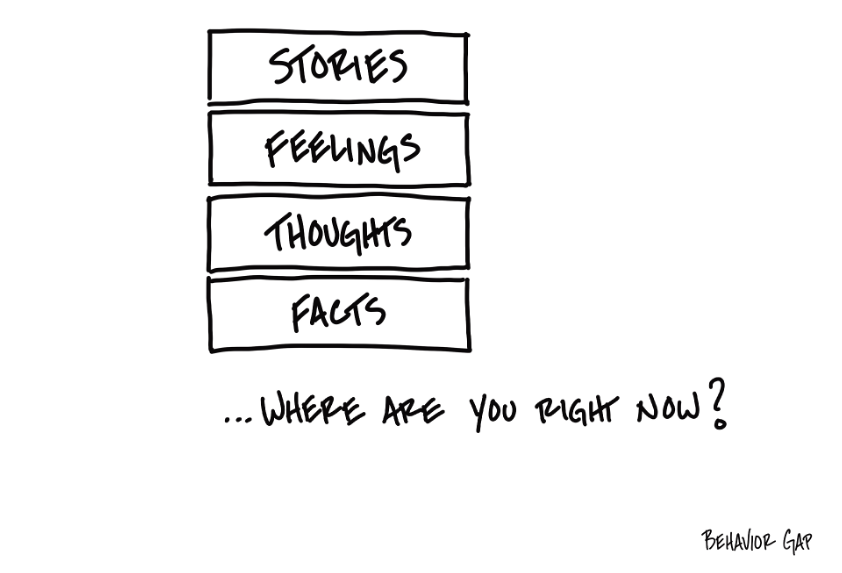

Most decisions begin at the top of the stack, not the bottom.

It starts with a story. A story about markets being too high. A story about a crash coming. A story about a new opportunity that everyone seems to be making money from. Stories are powerful because they are simple, emotional, and easy to share. They feel convincing even when they are incomplete.

Stories then trigger feelings. Fear. Greed. Anxiety. Excitement. Relief. Regret. Once feelings enter the room, logic quietly steps out.

At this stage, the body reacts faster than the brain. Heart rate changes. Sleep gets affected. Conversations become charged. Decisions start feeling urgent.

Feelings then shape thoughts. Thoughts like maybe I should exit. Maybe I should wait. Maybe I should do something different this time. These thoughts feel rational because they sound cautious or proactive. But they are already contaminated by emotion.

Only at the bottom are facts.

Actual data. Long term returns. Valuations across cycles. Asset allocation. Time horizon. Cash flows. Goals. Risk capacity. Facts are boring. Facts do not shout. Facts do not trend on social media. But facts are the only solid ground an investor has.

The real behavioral gap in investing is not lack of information. It is the inability to stay at the level of facts when everything around you is pulling you upward into stories and feelings.

Great investors learn to reverse the stack.

They start with facts. They acknowledge feelings without obeying them. They question their thoughts instead of acting on them. And they treat stories as noise unless backed by evidence.

The most powerful investing question is not What should I do right now.

It is Where am I right now.

Am I operating from facts. Or am I reacting to a story dressed up as insight.

Your returns will largely depend on how often you catch yourself climbing the wrong ladder.

and then tap on

and then tap on

0 Comments