The New Highs Belong to Those Who…

Every investor wants the straight line. The clean upward slope. The calm journey where portfolios rise quietly and predictably. But markets do not move like that. They never have. They rise through noise, uncertainty, and discomfort.

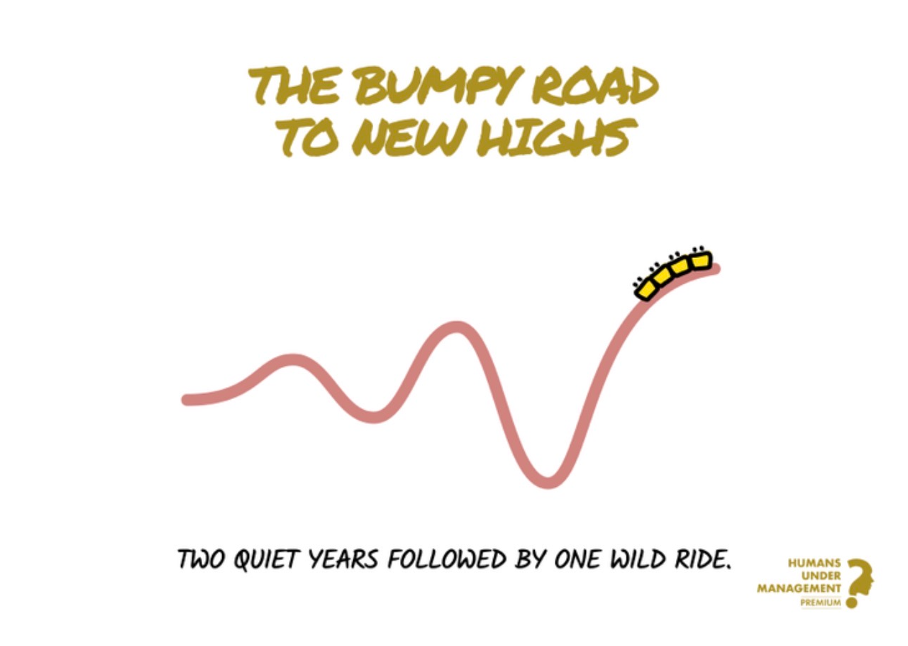

Most years in the market feel ordinary. Nothing dramatic. Nothing exciting. Two quiet years. Portfolios drift. Returns feel slow. You question whether anything is happening at all.

Then suddenly, out of nowhere, comes one wild year. A surge. A jump. A moment when years of patience show up in a few months of reward. The market has always worked this way. Long stretches of boredom followed by short bursts of brilliance.

The problem is that most investors give up during the quiet years. They look at the small wiggles on the screen and assume that the lack of excitement means the lack of progress. They forget that the path to new highs is bumpy by design.

Volatility is not a malfunction of markets. It is the mechanism. The price you pay for long term wealth creation is temporary discomfort.

Think of a rollercoaster. You only reach the highest point because you were willing to stay on during the lows. You cannot demand the thrill of the rise without accepting the dips that make it possible.

In investing, the dip is not the enemy. It is the evidence that risk is real. And because risk is real, returns exist.

The quiet years test your patience. The wild year rewards your discipline. New highs belong to those who remain seated while others jump off at the first sign of turbulence.

The next time your portfolio moves sideways or dips, remember this. You are not off track. You are simply on the bumpy road that every long-term investor must travel.

Stay the course. The ride is worth it.

and then tap on

and then tap on

0 Comments